July 10, 2019

The Fluid Chains team with special thanks to @ Nayib Kiuhan for the thoughtful work, has produced a wonderful new document for the ExO Economy and OpenExO Community that I wanted to share here. It was just released today.

This document will also become a part of the Intercom help system on this platform soon if not already.

As many of you know, sometimes gifts of EXOS are given out. When that happened, we use an application created by Fluid Chains that we call the gift app for the management and distribution of the tokens. We originally this this manually. It was painful for everyone involved. We don't do that anymore. :)

Here is the source Post on Yoti, KYC/AML, and why we do what we do in this area. This was produced because this was BY FAR the most frequently asked topic for help/questions in the last several weeks.

OpenExO is using Yoti as its KYC/AML (Know Your Customer / Anti Money Laundry) provider, where the users can create their own Digital Identity. YOTI, a UK based company, is in compliance with GDPR regulation, and the three main compliance accreditations they hold are:

ISO 27001: the international standard for information security management, and is now the best practice for security around the world. ISO 27001 is about protecting all kinds of data, not just personal data. So that’s everything from how the monitor data, who enters Yoti’s offices to how they pick any suppliers or partners to work with.

SOC 2 Type 1: SOC2 (Service Organisation Controls) is all about companies being able to trust each other when providing and outsourcing services. SOC 2 is one of the most respected and rigorous auditing standards for security in the business world. It’s considered rigorous enough for governments, major banks, and the biggest tech companies to use it.

PAS 1296: It’s a Publicly Available Specification (PAS) for Online Age Checking. It sets out regulatory best practices for the sale of age-restricted goods or access to age-restricted services.

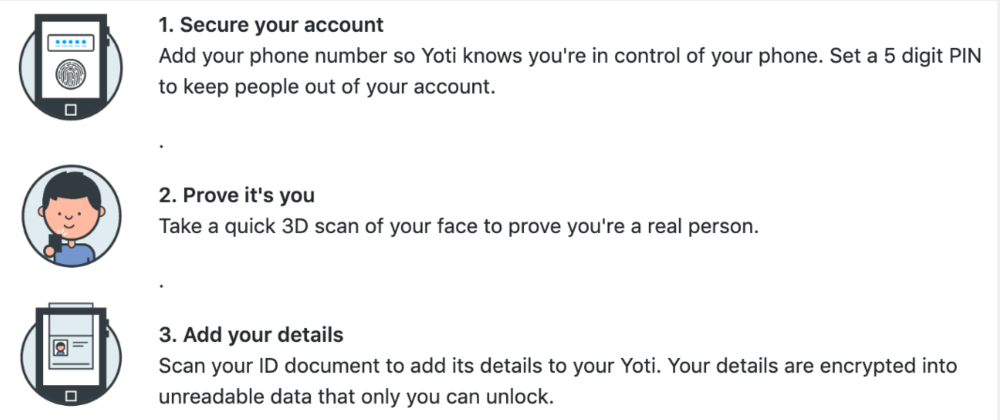

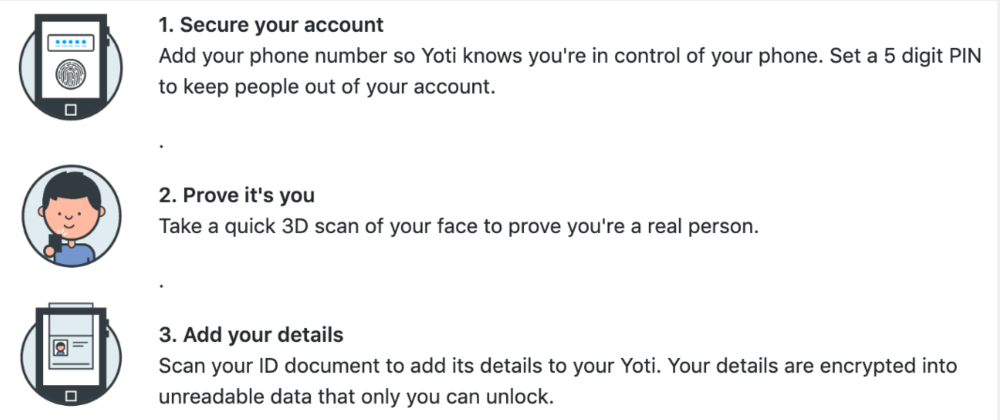

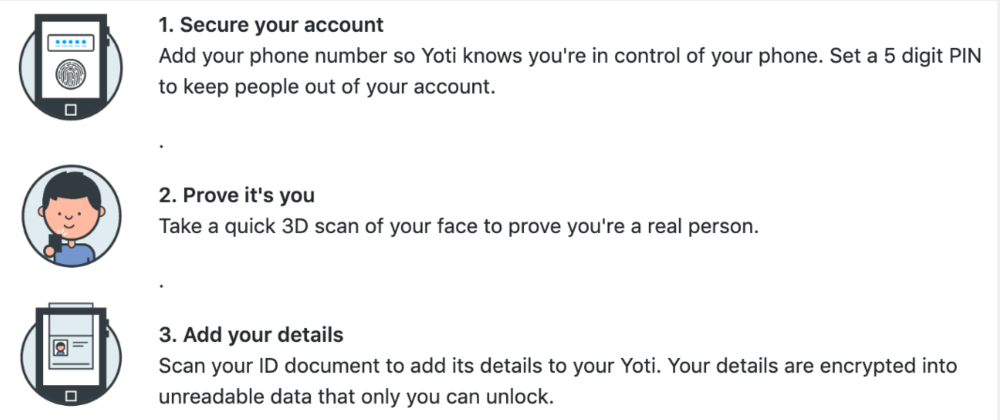

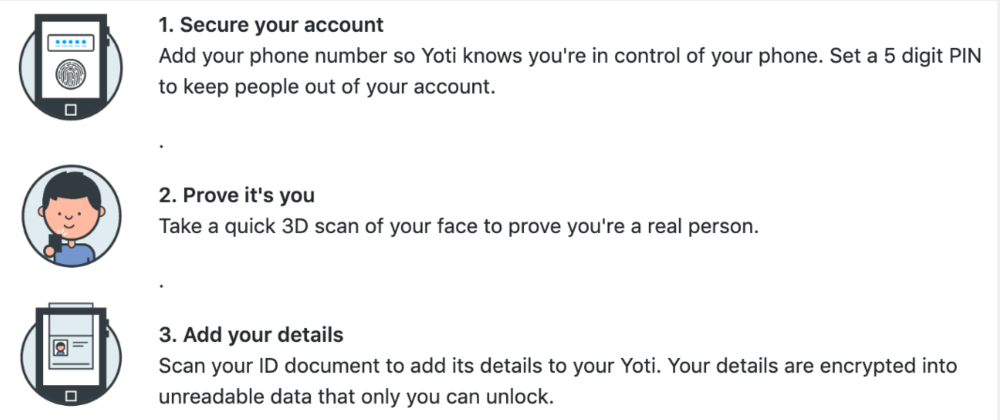

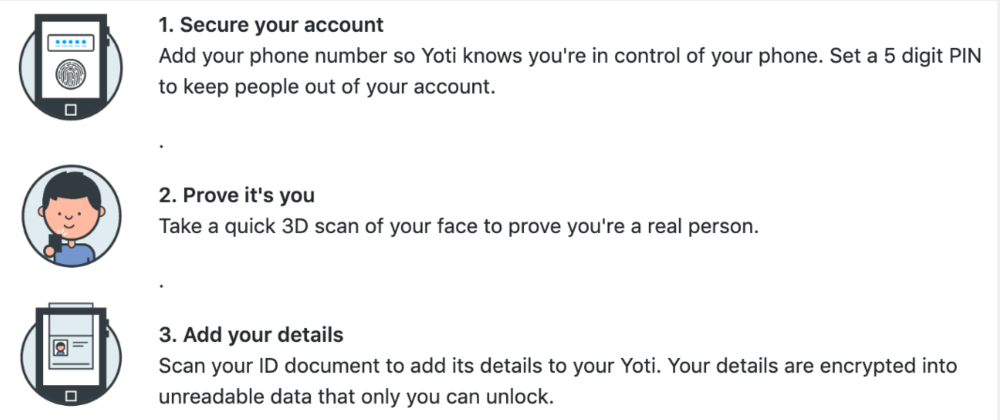

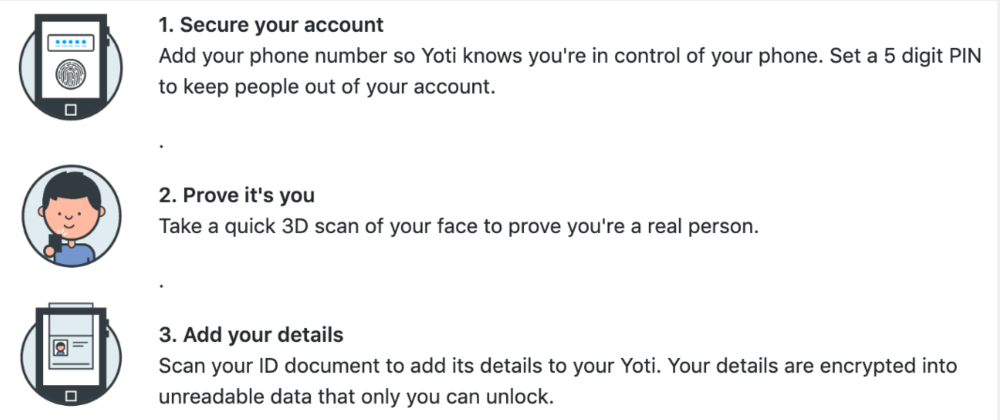

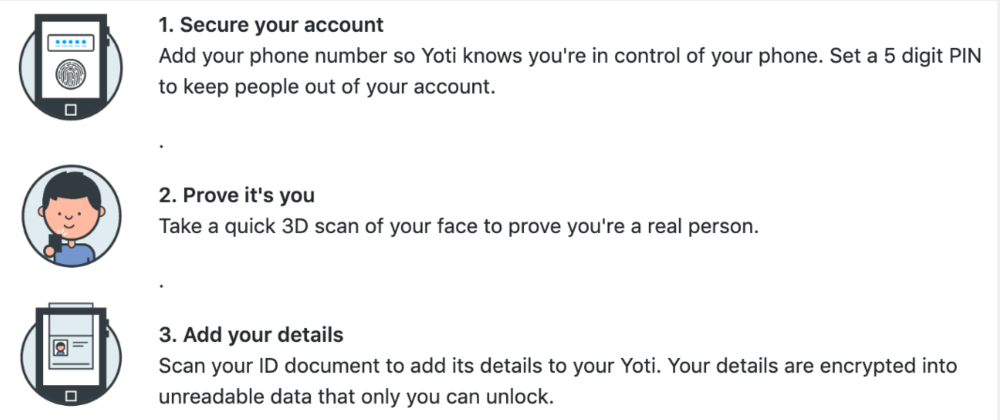

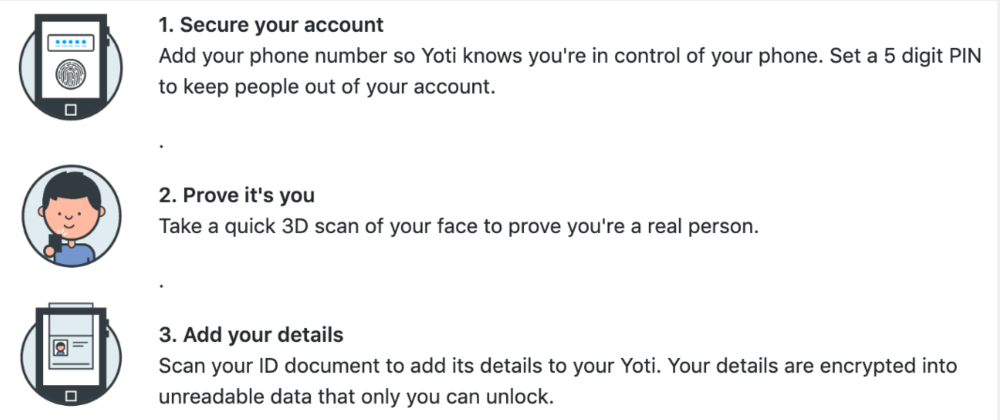

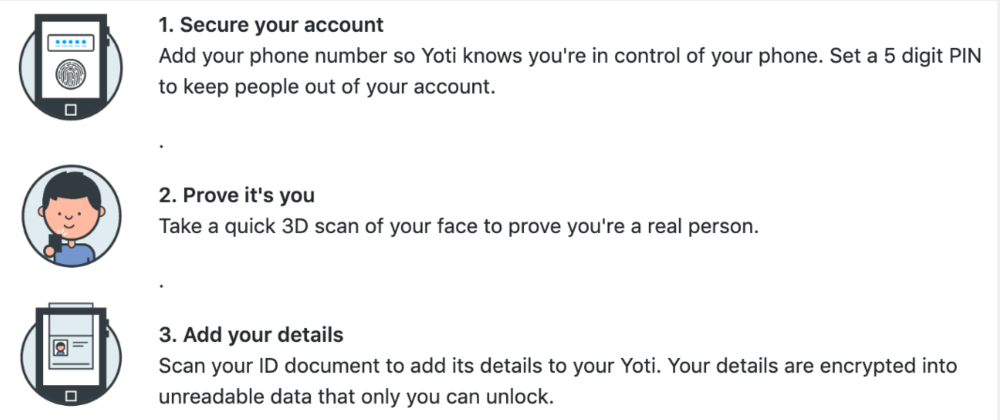

YOTI’s global reach permits users to validate their government-issued IDs from more than 160 countries, letting users create their own Digital Identity, through a process that uses Bank-level encryption. After you have downloaded and installed your Yoti App on your iPhone or Android phone/tablet, the steps to create your Yoti Digital ID are:

Yoti is being used by Exchanges and Digital Assets Trading Platforms ( Block Ex, MetaliCoin, Nova, CRIX), Industry companies ( nCloud, Electroneum, Trilliant, TautaChrome, Fun Fair Technologies), and works closely with governments and regulators ( FCA, CTSI, NPCC, OIX, PASS, OFCOM, BRC).

Know your customer (KYC) refers to due diligence activities that financial institutions and other regulated companies must perform to ascertain relevant personal information from their clients for the purpose of doing business with them.

Anti-money Laundering (AML) refers to a set of procedures, laws, and regulations designed to stop the practice of generating income through illegal actions.

As the world begins to adopt cryptocurrency, it’s clear that mass adoption is only possible if governments and corporations embrace the use of cryptocurrency. However, in order for this to occur, cryptocurrencies must ensure regulation is adhered to.

The ExO Economy embraces KYC and AML compliance in compliance with the 5th EU Anti-Money Laundering Directive (AMLD 5). This enables us to work with governments and corporations, who are helping us to introduce EXOS to a worldwide community.

We have become KYC and AML compliant by introducing a verification process that all our users must adhere to, giving the governments and corporations of the world a cryptocurrency they can trust.

SOURCE: ExO Economy Github

In summary, since the earliest days when the ExO Economy was an idea called the OpenExO Protocol back in 2016 we have strived to achieve super-credibility (P. Diamandis) and Transparency within the bounds of governing laws that sometimes impact what we can and cannot do or say.

Please let us know if there is something about the ExO Economy you want to know more about and we'll use those requests as a guideline to continued content generation.

Best,

Kent Langley and the ExO Economy Team

---

This Post is Part of a Multi-Part Series.

The ExO Economy Primer

· Part 1: Yoti and KYC / AML: Or, Why is compliance important? An ExO Economy Post

· Part 2: Staking EXOS in the ExO Economy, Your Economy

· Part 3: The Cities of the ExO Economy Blockchain

· Part 5: The ExO Economy Tipbot

Original content was published by ExOEconomy - Part 1: Yoti and KYC / AML: Or, Why is compliance important? An ExO Economy Post.

July 10, 2019

The Fluid Chains team with special thanks to @ Nayib Kiuhan for the thoughtful work, has produced a wonderful new document for the ExO Economy and OpenExO Community that I wanted to share here. It was just released today.

This document will also become a part of the Intercom help system on this platform soon if not already.

As many of you know, sometimes gifts of EXOS are given out. When that happened, we use an application created by Fluid Chains that we call the gift app for the management and distribution of the tokens. We originally this this manually. It was painful for everyone involved. We don't do that anymore. :)

Here is the source Post on Yoti, KYC/AML, and why we do what we do in this area. This was produced because this was BY FAR the most frequently asked topic for help/questions in the last several weeks.

OpenExO is using Yoti as its KYC/AML (Know Your Customer / Anti Money Laundry) provider, where the users can create their own Digital Identity. YOTI, a UK based company, is in compliance with GDPR regulation, and the three main compliance accreditations they hold are:

ISO 27001: the international standard for information security management, and is now the best practice for security around the world. ISO 27001 is about protecting all kinds of data, not just personal data. So that’s everything from how the monitor data, who enters Yoti’s offices to how they pick any suppliers or partners to work with.

SOC 2 Type 1: SOC2 (Service Organisation Controls) is all about companies being able to trust each other when providing and outsourcing services. SOC 2 is one of the most respected and rigorous auditing standards for security in the business world. It’s considered rigorous enough for governments, major banks, and the biggest tech companies to use it.

PAS 1296: It’s a Publicly Available Specification (PAS) for Online Age Checking. It sets out regulatory best practices for the sale of age-restricted goods or access to age-restricted services.

YOTI’s global reach permits users to validate their government-issued IDs from more than 160 countries, letting users create their own Digital Identity, through a process that uses Bank-level encryption. After you have downloaded and installed your Yoti App on your iPhone or Android phone/tablet, the steps to create your Yoti Digital ID are:

Yoti is being used by Exchanges and Digital Assets Trading Platforms ( Block Ex, MetaliCoin, Nova, CRIX), Industry companies ( nCloud, Electroneum, Trilliant, TautaChrome, Fun Fair Technologies), and works closely with governments and regulators ( FCA, CTSI, NPCC, OIX, PASS, OFCOM, BRC).

Know your customer (KYC) refers to due diligence activities that financial institutions and other regulated companies must perform to ascertain relevant personal information from their clients for the purpose of doing business with them.

Anti-money Laundering (AML) refers to a set of procedures, laws, and regulations designed to stop the practice of generating income through illegal actions.

As the world begins to adopt cryptocurrency, it’s clear that mass adoption is only possible if governments and corporations embrace the use of cryptocurrency. However, in order for this to occur, cryptocurrencies must ensure regulation is adhered to.

The ExO Economy embraces KYC and AML compliance in compliance with the 5th EU Anti-Money Laundering Directive (AMLD 5). This enables us to work with governments and corporations, who are helping us to introduce EXOS to a worldwide community.

We have become KYC and AML compliant by introducing a verification process that all our users must adhere to, giving the governments and corporations of the world a cryptocurrency they can trust.

SOURCE: ExO Economy Github

In summary, since the earliest days when the ExO Economy was an idea called the OpenExO Protocol back in 2016 we have strived to achieve super-credibility (P. Diamandis) and Transparency within the bounds of governing laws that sometimes impact what we can and cannot do or say.

Please let us know if there is something about the ExO Economy you want to know more about and we'll use those requests as a guideline to continued content generation.

Best,

Kent Langley and the ExO Economy Team

---

This Post is Part of a Multi-Part Series.

The ExO Economy Primer

· Part 1: Yoti and KYC / AML: Or, Why is compliance important? An ExO Economy Post

· Part 2: Staking EXOS in the ExO Economy, Your Economy

· Part 3: The Cities of the ExO Economy Blockchain

· Part 5: The ExO Economy Tipbot

Original content was published by ExOEconomy - Part 1: Yoti and KYC / AML: Or, Why is compliance important? An ExO Economy Post.

July 10, 2019

The Fluid Chains team with special thanks to @ Nayib Kiuhan for the thoughtful work, has produced a wonderful new document for the ExO Economy and OpenExO Community that I wanted to share here. It was just released today.

This document will also become a part of the Intercom help system on this platform soon if not already.

As many of you know, sometimes gifts of EXOS are given out. When that happened, we use an application created by Fluid Chains that we call the gift app for the management and distribution of the tokens. We originally this this manually. It was painful for everyone involved. We don't do that anymore. :)

Here is the source Post on Yoti, KYC/AML, and why we do what we do in this area. This was produced because this was BY FAR the most frequently asked topic for help/questions in the last several weeks.

OpenExO is using Yoti as its KYC/AML (Know Your Customer / Anti Money Laundry) provider, where the users can create their own Digital Identity. YOTI, a UK based company, is in compliance with GDPR regulation, and the three main compliance accreditations they hold are:

ISO 27001: the international standard for information security management, and is now the best practice for security around the world. ISO 27001 is about protecting all kinds of data, not just personal data. So that’s everything from how the monitor data, who enters Yoti’s offices to how they pick any suppliers or partners to work with.

SOC 2 Type 1: SOC2 (Service Organisation Controls) is all about companies being able to trust each other when providing and outsourcing services. SOC 2 is one of the most respected and rigorous auditing standards for security in the business world. It’s considered rigorous enough for governments, major banks, and the biggest tech companies to use it.

PAS 1296: It’s a Publicly Available Specification (PAS) for Online Age Checking. It sets out regulatory best practices for the sale of age-restricted goods or access to age-restricted services.

YOTI’s global reach permits users to validate their government-issued IDs from more than 160 countries, letting users create their own Digital Identity, through a process that uses Bank-level encryption. After you have downloaded and installed your Yoti App on your iPhone or Android phone/tablet, the steps to create your Yoti Digital ID are:

Yoti is being used by Exchanges and Digital Assets Trading Platforms ( Block Ex, MetaliCoin, Nova, CRIX), Industry companies ( nCloud, Electroneum, Trilliant, TautaChrome, Fun Fair Technologies), and works closely with governments and regulators ( FCA, CTSI, NPCC, OIX, PASS, OFCOM, BRC).

Know your customer (KYC) refers to due diligence activities that financial institutions and other regulated companies must perform to ascertain relevant personal information from their clients for the purpose of doing business with them.

Anti-money Laundering (AML) refers to a set of procedures, laws, and regulations designed to stop the practice of generating income through illegal actions.

As the world begins to adopt cryptocurrency, it’s clear that mass adoption is only possible if governments and corporations embrace the use of cryptocurrency. However, in order for this to occur, cryptocurrencies must ensure regulation is adhered to.

The ExO Economy embraces KYC and AML compliance in compliance with the 5th EU Anti-Money Laundering Directive (AMLD 5). This enables us to work with governments and corporations, who are helping us to introduce EXOS to a worldwide community.

We have become KYC and AML compliant by introducing a verification process that all our users must adhere to, giving the governments and corporations of the world a cryptocurrency they can trust.

SOURCE: ExO Economy Github

In summary, since the earliest days when the ExO Economy was an idea called the OpenExO Protocol back in 2016 we have strived to achieve super-credibility (P. Diamandis) and Transparency within the bounds of governing laws that sometimes impact what we can and cannot do or say.

Please let us know if there is something about the ExO Economy you want to know more about and we'll use those requests as a guideline to continued content generation.

Best,

Kent Langley and the ExO Economy Team

---

This Post is Part of a Multi-Part Series.

The ExO Economy Primer

· Part 1: Yoti and KYC / AML: Or, Why is compliance important? An ExO Economy Post

· Part 2: Staking EXOS in the ExO Economy, Your Economy

· Part 3: The Cities of the ExO Economy Blockchain

· Part 5: The ExO Economy Tipbot

Original content was published by ExOEconomy - Part 1: Yoti and KYC / AML: Or, Why is compliance important? An ExO Economy Post.

July 10, 2019

The Fluid Chains team with special thanks to @ Nayib Kiuhan for the thoughtful work, has produced a wonderful new document for the ExO Economy and OpenExO Community that I wanted to share here. It was just released today.

This document will also become a part of the Intercom help system on this platform soon if not already.

As many of you know, sometimes gifts of EXOS are given out. When that happened, we use an application created by Fluid Chains that we call the gift app for the management and distribution of the tokens. We originally this this manually. It was painful for everyone involved. We don't do that anymore. :)

Here is the source Post on Yoti, KYC/AML, and why we do what we do in this area. This was produced because this was BY FAR the most frequently asked topic for help/questions in the last several weeks.

OpenExO is using Yoti as its KYC/AML (Know Your Customer / Anti Money Laundry) provider, where the users can create their own Digital Identity. YOTI, a UK based company, is in compliance with GDPR regulation, and the three main compliance accreditations they hold are:

ISO 27001: the international standard for information security management, and is now the best practice for security around the world. ISO 27001 is about protecting all kinds of data, not just personal data. So that’s everything from how the monitor data, who enters Yoti’s offices to how they pick any suppliers or partners to work with.

SOC 2 Type 1: SOC2 (Service Organisation Controls) is all about companies being able to trust each other when providing and outsourcing services. SOC 2 is one of the most respected and rigorous auditing standards for security in the business world. It’s considered rigorous enough for governments, major banks, and the biggest tech companies to use it.

PAS 1296: It’s a Publicly Available Specification (PAS) for Online Age Checking. It sets out regulatory best practices for the sale of age-restricted goods or access to age-restricted services.

YOTI’s global reach permits users to validate their government-issued IDs from more than 160 countries, letting users create their own Digital Identity, through a process that uses Bank-level encryption. After you have downloaded and installed your Yoti App on your iPhone or Android phone/tablet, the steps to create your Yoti Digital ID are:

Yoti is being used by Exchanges and Digital Assets Trading Platforms ( Block Ex, MetaliCoin, Nova, CRIX), Industry companies ( nCloud, Electroneum, Trilliant, TautaChrome, Fun Fair Technologies), and works closely with governments and regulators ( FCA, CTSI, NPCC, OIX, PASS, OFCOM, BRC).

Know your customer (KYC) refers to due diligence activities that financial institutions and other regulated companies must perform to ascertain relevant personal information from their clients for the purpose of doing business with them.

Anti-money Laundering (AML) refers to a set of procedures, laws, and regulations designed to stop the practice of generating income through illegal actions.

As the world begins to adopt cryptocurrency, it’s clear that mass adoption is only possible if governments and corporations embrace the use of cryptocurrency. However, in order for this to occur, cryptocurrencies must ensure regulation is adhered to.

The ExO Economy embraces KYC and AML compliance in compliance with the 5th EU Anti-Money Laundering Directive (AMLD 5). This enables us to work with governments and corporations, who are helping us to introduce EXOS to a worldwide community.

We have become KYC and AML compliant by introducing a verification process that all our users must adhere to, giving the governments and corporations of the world a cryptocurrency they can trust.

SOURCE: ExO Economy Github

In summary, since the earliest days when the ExO Economy was an idea called the OpenExO Protocol back in 2016 we have strived to achieve super-credibility (P. Diamandis) and Transparency within the bounds of governing laws that sometimes impact what we can and cannot do or say.

Please let us know if there is something about the ExO Economy you want to know more about and we'll use those requests as a guideline to continued content generation.

Best,

Kent Langley and the ExO Economy Team

---

This Post is Part of a Multi-Part Series.

The ExO Economy Primer

· Part 1: Yoti and KYC / AML: Or, Why is compliance important? An ExO Economy Post

· Part 2: Staking EXOS in the ExO Economy, Your Economy

· Part 3: The Cities of the ExO Economy Blockchain

· Part 5: The ExO Economy Tipbot

Original content was published by ExOEconomy - Part 1: Yoti and KYC / AML: Or, Why is compliance important? An ExO Economy Post.

July 10, 2019

The Fluid Chains team with special thanks to @ Nayib Kiuhan for the thoughtful work, has produced a wonderful new document for the ExO Economy and OpenExO Community that I wanted to share here. It was just released today.

This document will also become a part of the Intercom help system on this platform soon if not already.

As many of you know, sometimes gifts of EXOS are given out. When that happened, we use an application created by Fluid Chains that we call the gift app for the management and distribution of the tokens. We originally this this manually. It was painful for everyone involved. We don't do that anymore. :)

Here is the source Post on Yoti, KYC/AML, and why we do what we do in this area. This was produced because this was BY FAR the most frequently asked topic for help/questions in the last several weeks.

OpenExO is using Yoti as its KYC/AML (Know Your Customer / Anti Money Laundry) provider, where the users can create their own Digital Identity. YOTI, a UK based company, is in compliance with GDPR regulation, and the three main compliance accreditations they hold are:

ISO 27001: the international standard for information security management, and is now the best practice for security around the world. ISO 27001 is about protecting all kinds of data, not just personal data. So that’s everything from how the monitor data, who enters Yoti’s offices to how they pick any suppliers or partners to work with.

SOC 2 Type 1: SOC2 (Service Organisation Controls) is all about companies being able to trust each other when providing and outsourcing services. SOC 2 is one of the most respected and rigorous auditing standards for security in the business world. It’s considered rigorous enough for governments, major banks, and the biggest tech companies to use it.

PAS 1296: It’s a Publicly Available Specification (PAS) for Online Age Checking. It sets out regulatory best practices for the sale of age-restricted goods or access to age-restricted services.

YOTI’s global reach permits users to validate their government-issued IDs from more than 160 countries, letting users create their own Digital Identity, through a process that uses Bank-level encryption. After you have downloaded and installed your Yoti App on your iPhone or Android phone/tablet, the steps to create your Yoti Digital ID are:

Yoti is being used by Exchanges and Digital Assets Trading Platforms ( Block Ex, MetaliCoin, Nova, CRIX), Industry companies ( nCloud, Electroneum, Trilliant, TautaChrome, Fun Fair Technologies), and works closely with governments and regulators ( FCA, CTSI, NPCC, OIX, PASS, OFCOM, BRC).

Know your customer (KYC) refers to due diligence activities that financial institutions and other regulated companies must perform to ascertain relevant personal information from their clients for the purpose of doing business with them.

Anti-money Laundering (AML) refers to a set of procedures, laws, and regulations designed to stop the practice of generating income through illegal actions.

As the world begins to adopt cryptocurrency, it’s clear that mass adoption is only possible if governments and corporations embrace the use of cryptocurrency. However, in order for this to occur, cryptocurrencies must ensure regulation is adhered to.

The ExO Economy embraces KYC and AML compliance in compliance with the 5th EU Anti-Money Laundering Directive (AMLD 5). This enables us to work with governments and corporations, who are helping us to introduce EXOS to a worldwide community.

We have become KYC and AML compliant by introducing a verification process that all our users must adhere to, giving the governments and corporations of the world a cryptocurrency they can trust.

SOURCE: ExO Economy Github

In summary, since the earliest days when the ExO Economy was an idea called the OpenExO Protocol back in 2016 we have strived to achieve super-credibility (P. Diamandis) and Transparency within the bounds of governing laws that sometimes impact what we can and cannot do or say.

Please let us know if there is something about the ExO Economy you want to know more about and we'll use those requests as a guideline to continued content generation.

Best,

Kent Langley and the ExO Economy Team

---

This Post is Part of a Multi-Part Series.

The ExO Economy Primer

· Part 1: Yoti and KYC / AML: Or, Why is compliance important? An ExO Economy Post

· Part 2: Staking EXOS in the ExO Economy, Your Economy

· Part 3: The Cities of the ExO Economy Blockchain

· Part 5: The ExO Economy Tipbot

Original content was published by ExOEconomy - Part 1: Yoti and KYC / AML: Or, Why is compliance important? An ExO Economy Post.

July 10, 2019

The Fluid Chains team with special thanks to @ Nayib Kiuhan for the thoughtful work, has produced a wonderful new document for the ExO Economy and OpenExO Community that I wanted to share here. It was just released today.

This document will also become a part of the Intercom help system on this platform soon if not already.

As many of you know, sometimes gifts of EXOS are given out. When that happened, we use an application created by Fluid Chains that we call the gift app for the management and distribution of the tokens. We originally this this manually. It was painful for everyone involved. We don't do that anymore. :)

Here is the source Post on Yoti, KYC/AML, and why we do what we do in this area. This was produced because this was BY FAR the most frequently asked topic for help/questions in the last several weeks.

OpenExO is using Yoti as its KYC/AML (Know Your Customer / Anti Money Laundry) provider, where the users can create their own Digital Identity. YOTI, a UK based company, is in compliance with GDPR regulation, and the three main compliance accreditations they hold are:

ISO 27001: the international standard for information security management, and is now the best practice for security around the world. ISO 27001 is about protecting all kinds of data, not just personal data. So that’s everything from how the monitor data, who enters Yoti’s offices to how they pick any suppliers or partners to work with.

SOC 2 Type 1: SOC2 (Service Organisation Controls) is all about companies being able to trust each other when providing and outsourcing services. SOC 2 is one of the most respected and rigorous auditing standards for security in the business world. It’s considered rigorous enough for governments, major banks, and the biggest tech companies to use it.

PAS 1296: It’s a Publicly Available Specification (PAS) for Online Age Checking. It sets out regulatory best practices for the sale of age-restricted goods or access to age-restricted services.

YOTI’s global reach permits users to validate their government-issued IDs from more than 160 countries, letting users create their own Digital Identity, through a process that uses Bank-level encryption. After you have downloaded and installed your Yoti App on your iPhone or Android phone/tablet, the steps to create your Yoti Digital ID are:

Yoti is being used by Exchanges and Digital Assets Trading Platforms ( Block Ex, MetaliCoin, Nova, CRIX), Industry companies ( nCloud, Electroneum, Trilliant, TautaChrome, Fun Fair Technologies), and works closely with governments and regulators ( FCA, CTSI, NPCC, OIX, PASS, OFCOM, BRC).

Know your customer (KYC) refers to due diligence activities that financial institutions and other regulated companies must perform to ascertain relevant personal information from their clients for the purpose of doing business with them.

Anti-money Laundering (AML) refers to a set of procedures, laws, and regulations designed to stop the practice of generating income through illegal actions.

As the world begins to adopt cryptocurrency, it’s clear that mass adoption is only possible if governments and corporations embrace the use of cryptocurrency. However, in order for this to occur, cryptocurrencies must ensure regulation is adhered to.

The ExO Economy embraces KYC and AML compliance in compliance with the 5th EU Anti-Money Laundering Directive (AMLD 5). This enables us to work with governments and corporations, who are helping us to introduce EXOS to a worldwide community.

We have become KYC and AML compliant by introducing a verification process that all our users must adhere to, giving the governments and corporations of the world a cryptocurrency they can trust.

SOURCE: ExO Economy Github

In summary, since the earliest days when the ExO Economy was an idea called the OpenExO Protocol back in 2016 we have strived to achieve super-credibility (P. Diamandis) and Transparency within the bounds of governing laws that sometimes impact what we can and cannot do or say.

Please let us know if there is something about the ExO Economy you want to know more about and we'll use those requests as a guideline to continued content generation.

Best,

Kent Langley and the ExO Economy Team

---

This Post is Part of a Multi-Part Series.

The ExO Economy Primer

· Part 1: Yoti and KYC / AML: Or, Why is compliance important? An ExO Economy Post

· Part 2: Staking EXOS in the ExO Economy, Your Economy

· Part 3: The Cities of the ExO Economy Blockchain

· Part 5: The ExO Economy Tipbot

Original content was published by ExOEconomy - Part 1: Yoti and KYC / AML: Or, Why is compliance important? An ExO Economy Post.

July 10, 2019

The Fluid Chains team with special thanks to @ Nayib Kiuhan for the thoughtful work, has produced a wonderful new document for the ExO Economy and OpenExO Community that I wanted to share here. It was just released today.

This document will also become a part of the Intercom help system on this platform soon if not already.

As many of you know, sometimes gifts of EXOS are given out. When that happened, we use an application created by Fluid Chains that we call the gift app for the management and distribution of the tokens. We originally this this manually. It was painful for everyone involved. We don't do that anymore. :)

Here is the source Post on Yoti, KYC/AML, and why we do what we do in this area. This was produced because this was BY FAR the most frequently asked topic for help/questions in the last several weeks.

OpenExO is using Yoti as its KYC/AML (Know Your Customer / Anti Money Laundry) provider, where the users can create their own Digital Identity. YOTI, a UK based company, is in compliance with GDPR regulation, and the three main compliance accreditations they hold are:

ISO 27001: the international standard for information security management, and is now the best practice for security around the world. ISO 27001 is about protecting all kinds of data, not just personal data. So that’s everything from how the monitor data, who enters Yoti’s offices to how they pick any suppliers or partners to work with.

SOC 2 Type 1: SOC2 (Service Organisation Controls) is all about companies being able to trust each other when providing and outsourcing services. SOC 2 is one of the most respected and rigorous auditing standards for security in the business world. It’s considered rigorous enough for governments, major banks, and the biggest tech companies to use it.

PAS 1296: It’s a Publicly Available Specification (PAS) for Online Age Checking. It sets out regulatory best practices for the sale of age-restricted goods or access to age-restricted services.

YOTI’s global reach permits users to validate their government-issued IDs from more than 160 countries, letting users create their own Digital Identity, through a process that uses Bank-level encryption. After you have downloaded and installed your Yoti App on your iPhone or Android phone/tablet, the steps to create your Yoti Digital ID are:

Yoti is being used by Exchanges and Digital Assets Trading Platforms ( Block Ex, MetaliCoin, Nova, CRIX), Industry companies ( nCloud, Electroneum, Trilliant, TautaChrome, Fun Fair Technologies), and works closely with governments and regulators ( FCA, CTSI, NPCC, OIX, PASS, OFCOM, BRC).

Know your customer (KYC) refers to due diligence activities that financial institutions and other regulated companies must perform to ascertain relevant personal information from their clients for the purpose of doing business with them.

Anti-money Laundering (AML) refers to a set of procedures, laws, and regulations designed to stop the practice of generating income through illegal actions.

As the world begins to adopt cryptocurrency, it’s clear that mass adoption is only possible if governments and corporations embrace the use of cryptocurrency. However, in order for this to occur, cryptocurrencies must ensure regulation is adhered to.

The ExO Economy embraces KYC and AML compliance in compliance with the 5th EU Anti-Money Laundering Directive (AMLD 5). This enables us to work with governments and corporations, who are helping us to introduce EXOS to a worldwide community.

We have become KYC and AML compliant by introducing a verification process that all our users must adhere to, giving the governments and corporations of the world a cryptocurrency they can trust.

SOURCE: ExO Economy Github

In summary, since the earliest days when the ExO Economy was an idea called the OpenExO Protocol back in 2016 we have strived to achieve super-credibility (P. Diamandis) and Transparency within the bounds of governing laws that sometimes impact what we can and cannot do or say.

Please let us know if there is something about the ExO Economy you want to know more about and we'll use those requests as a guideline to continued content generation.

Best,

Kent Langley and the ExO Economy Team

---

This Post is Part of a Multi-Part Series.

The ExO Economy Primer

· Part 1: Yoti and KYC / AML: Or, Why is compliance important? An ExO Economy Post

· Part 2: Staking EXOS in the ExO Economy, Your Economy

· Part 3: The Cities of the ExO Economy Blockchain

· Part 5: The ExO Economy Tipbot

Original content was published by ExOEconomy - Part 1: Yoti and KYC / AML: Or, Why is compliance important? An ExO Economy Post.

July 10, 2019

The Fluid Chains team with special thanks to @ Nayib Kiuhan for the thoughtful work, has produced a wonderful new document for the ExO Economy and OpenExO Community that I wanted to share here. It was just released today.

This document will also become a part of the Intercom help system on this platform soon if not already.

As many of you know, sometimes gifts of EXOS are given out. When that happened, we use an application created by Fluid Chains that we call the gift app for the management and distribution of the tokens. We originally this this manually. It was painful for everyone involved. We don't do that anymore. :)

Here is the source Post on Yoti, KYC/AML, and why we do what we do in this area. This was produced because this was BY FAR the most frequently asked topic for help/questions in the last several weeks.

OpenExO is using Yoti as its KYC/AML (Know Your Customer / Anti Money Laundry) provider, where the users can create their own Digital Identity. YOTI, a UK based company, is in compliance with GDPR regulation, and the three main compliance accreditations they hold are:

ISO 27001: the international standard for information security management, and is now the best practice for security around the world. ISO 27001 is about protecting all kinds of data, not just personal data. So that’s everything from how the monitor data, who enters Yoti’s offices to how they pick any suppliers or partners to work with.

SOC 2 Type 1: SOC2 (Service Organisation Controls) is all about companies being able to trust each other when providing and outsourcing services. SOC 2 is one of the most respected and rigorous auditing standards for security in the business world. It’s considered rigorous enough for governments, major banks, and the biggest tech companies to use it.

PAS 1296: It’s a Publicly Available Specification (PAS) for Online Age Checking. It sets out regulatory best practices for the sale of age-restricted goods or access to age-restricted services.

YOTI’s global reach permits users to validate their government-issued IDs from more than 160 countries, letting users create their own Digital Identity, through a process that uses Bank-level encryption. After you have downloaded and installed your Yoti App on your iPhone or Android phone/tablet, the steps to create your Yoti Digital ID are:

Yoti is being used by Exchanges and Digital Assets Trading Platforms ( Block Ex, MetaliCoin, Nova, CRIX), Industry companies ( nCloud, Electroneum, Trilliant, TautaChrome, Fun Fair Technologies), and works closely with governments and regulators ( FCA, CTSI, NPCC, OIX, PASS, OFCOM, BRC).

Know your customer (KYC) refers to due diligence activities that financial institutions and other regulated companies must perform to ascertain relevant personal information from their clients for the purpose of doing business with them.

Anti-money Laundering (AML) refers to a set of procedures, laws, and regulations designed to stop the practice of generating income through illegal actions.

As the world begins to adopt cryptocurrency, it’s clear that mass adoption is only possible if governments and corporations embrace the use of cryptocurrency. However, in order for this to occur, cryptocurrencies must ensure regulation is adhered to.

The ExO Economy embraces KYC and AML compliance in compliance with the 5th EU Anti-Money Laundering Directive (AMLD 5). This enables us to work with governments and corporations, who are helping us to introduce EXOS to a worldwide community.

We have become KYC and AML compliant by introducing a verification process that all our users must adhere to, giving the governments and corporations of the world a cryptocurrency they can trust.

SOURCE: ExO Economy Github

In summary, since the earliest days when the ExO Economy was an idea called the OpenExO Protocol back in 2016 we have strived to achieve super-credibility (P. Diamandis) and Transparency within the bounds of governing laws that sometimes impact what we can and cannot do or say.

Please let us know if there is something about the ExO Economy you want to know more about and we'll use those requests as a guideline to continued content generation.

Best,

Kent Langley and the ExO Economy Team

---

This Post is Part of a Multi-Part Series.

The ExO Economy Primer

· Part 1: Yoti and KYC / AML: Or, Why is compliance important? An ExO Economy Post

· Part 2: Staking EXOS in the ExO Economy, Your Economy

· Part 3: The Cities of the ExO Economy Blockchain

· Part 5: The ExO Economy Tipbot

Original content was published by ExOEconomy - Part 1: Yoti and KYC / AML: Or, Why is compliance important? An ExO Economy Post.

July 10, 2019

The Fluid Chains team with special thanks to @ Nayib Kiuhan for the thoughtful work, has produced a wonderful new document for the ExO Economy and OpenExO Community that I wanted to share here. It was just released today.

This document will also become a part of the Intercom help system on this platform soon if not already.

As many of you know, sometimes gifts of EXOS are given out. When that happened, we use an application created by Fluid Chains that we call the gift app for the management and distribution of the tokens. We originally this this manually. It was painful for everyone involved. We don't do that anymore. :)

Here is the source Post on Yoti, KYC/AML, and why we do what we do in this area. This was produced because this was BY FAR the most frequently asked topic for help/questions in the last several weeks.

OpenExO is using Yoti as its KYC/AML (Know Your Customer / Anti Money Laundry) provider, where the users can create their own Digital Identity. YOTI, a UK based company, is in compliance with GDPR regulation, and the three main compliance accreditations they hold are:

ISO 27001: the international standard for information security management, and is now the best practice for security around the world. ISO 27001 is about protecting all kinds of data, not just personal data. So that’s everything from how the monitor data, who enters Yoti’s offices to how they pick any suppliers or partners to work with.

SOC 2 Type 1: SOC2 (Service Organisation Controls) is all about companies being able to trust each other when providing and outsourcing services. SOC 2 is one of the most respected and rigorous auditing standards for security in the business world. It’s considered rigorous enough for governments, major banks, and the biggest tech companies to use it.

PAS 1296: It’s a Publicly Available Specification (PAS) for Online Age Checking. It sets out regulatory best practices for the sale of age-restricted goods or access to age-restricted services.

YOTI’s global reach permits users to validate their government-issued IDs from more than 160 countries, letting users create their own Digital Identity, through a process that uses Bank-level encryption. After you have downloaded and installed your Yoti App on your iPhone or Android phone/tablet, the steps to create your Yoti Digital ID are:

Yoti is being used by Exchanges and Digital Assets Trading Platforms ( Block Ex, MetaliCoin, Nova, CRIX), Industry companies ( nCloud, Electroneum, Trilliant, TautaChrome, Fun Fair Technologies), and works closely with governments and regulators ( FCA, CTSI, NPCC, OIX, PASS, OFCOM, BRC).

Know your customer (KYC) refers to due diligence activities that financial institutions and other regulated companies must perform to ascertain relevant personal information from their clients for the purpose of doing business with them.

Anti-money Laundering (AML) refers to a set of procedures, laws, and regulations designed to stop the practice of generating income through illegal actions.

As the world begins to adopt cryptocurrency, it’s clear that mass adoption is only possible if governments and corporations embrace the use of cryptocurrency. However, in order for this to occur, cryptocurrencies must ensure regulation is adhered to.

The ExO Economy embraces KYC and AML compliance in compliance with the 5th EU Anti-Money Laundering Directive (AMLD 5). This enables us to work with governments and corporations, who are helping us to introduce EXOS to a worldwide community.

We have become KYC and AML compliant by introducing a verification process that all our users must adhere to, giving the governments and corporations of the world a cryptocurrency they can trust.

SOURCE: ExO Economy Github

In summary, since the earliest days when the ExO Economy was an idea called the OpenExO Protocol back in 2016 we have strived to achieve super-credibility (P. Diamandis) and Transparency within the bounds of governing laws that sometimes impact what we can and cannot do or say.

Please let us know if there is something about the ExO Economy you want to know more about and we'll use those requests as a guideline to continued content generation.

Best,

Kent Langley and the ExO Economy Team

---

This Post is Part of a Multi-Part Series.

The ExO Economy Primer

· Part 1: Yoti and KYC / AML: Or, Why is compliance important? An ExO Economy Post

· Part 2: Staking EXOS in the ExO Economy, Your Economy

· Part 3: The Cities of the ExO Economy Blockchain

· Part 5: The ExO Economy Tipbot

Original content was published by ExOEconomy - Part 1: Yoti and KYC / AML: Or, Why is compliance important? An ExO Economy Post.

July 10, 2019

The Fluid Chains team with special thanks to @ Nayib Kiuhan for the thoughtful work, has produced a wonderful new document for the ExO Economy and OpenExO Community that I wanted to share here. It was just released today.

This document will also become a part of the Intercom help system on this platform soon if not already.

As many of you know, sometimes gifts of EXOS are given out. When that happened, we use an application created by Fluid Chains that we call the gift app for the management and distribution of the tokens. We originally this this manually. It was painful for everyone involved. We don't do that anymore. :)

Here is the source Post on Yoti, KYC/AML, and why we do what we do in this area. This was produced because this was BY FAR the most frequently asked topic for help/questions in the last several weeks.

OpenExO is using Yoti as its KYC/AML (Know Your Customer / Anti Money Laundry) provider, where the users can create their own Digital Identity. YOTI, a UK based company, is in compliance with GDPR regulation, and the three main compliance accreditations they hold are:

ISO 27001: the international standard for information security management, and is now the best practice for security around the world. ISO 27001 is about protecting all kinds of data, not just personal data. So that’s everything from how the monitor data, who enters Yoti’s offices to how they pick any suppliers or partners to work with.

SOC 2 Type 1: SOC2 (Service Organisation Controls) is all about companies being able to trust each other when providing and outsourcing services. SOC 2 is one of the most respected and rigorous auditing standards for security in the business world. It’s considered rigorous enough for governments, major banks, and the biggest tech companies to use it.

PAS 1296: It’s a Publicly Available Specification (PAS) for Online Age Checking. It sets out regulatory best practices for the sale of age-restricted goods or access to age-restricted services.

YOTI’s global reach permits users to validate their government-issued IDs from more than 160 countries, letting users create their own Digital Identity, through a process that uses Bank-level encryption. After you have downloaded and installed your Yoti App on your iPhone or Android phone/tablet, the steps to create your Yoti Digital ID are:

Yoti is being used by Exchanges and Digital Assets Trading Platforms ( Block Ex, MetaliCoin, Nova, CRIX), Industry companies ( nCloud, Electroneum, Trilliant, TautaChrome, Fun Fair Technologies), and works closely with governments and regulators ( FCA, CTSI, NPCC, OIX, PASS, OFCOM, BRC).

Know your customer (KYC) refers to due diligence activities that financial institutions and other regulated companies must perform to ascertain relevant personal information from their clients for the purpose of doing business with them.

Anti-money Laundering (AML) refers to a set of procedures, laws, and regulations designed to stop the practice of generating income through illegal actions.

As the world begins to adopt cryptocurrency, it’s clear that mass adoption is only possible if governments and corporations embrace the use of cryptocurrency. However, in order for this to occur, cryptocurrencies must ensure regulation is adhered to.

The ExO Economy embraces KYC and AML compliance in compliance with the 5th EU Anti-Money Laundering Directive (AMLD 5). This enables us to work with governments and corporations, who are helping us to introduce EXOS to a worldwide community.

We have become KYC and AML compliant by introducing a verification process that all our users must adhere to, giving the governments and corporations of the world a cryptocurrency they can trust.

SOURCE: ExO Economy Github

In summary, since the earliest days when the ExO Economy was an idea called the OpenExO Protocol back in 2016 we have strived to achieve super-credibility (P. Diamandis) and Transparency within the bounds of governing laws that sometimes impact what we can and cannot do or say.

Please let us know if there is something about the ExO Economy you want to know more about and we'll use those requests as a guideline to continued content generation.

Best,

Kent Langley and the ExO Economy Team

---

This Post is Part of a Multi-Part Series.

The ExO Economy Primer

· Part 1: Yoti and KYC / AML: Or, Why is compliance important? An ExO Economy Post

· Part 2: Staking EXOS in the ExO Economy, Your Economy

· Part 3: The Cities of the ExO Economy Blockchain

· Part 5: The ExO Economy Tipbot

Original content was published by ExOEconomy - Part 1: Yoti and KYC / AML: Or, Why is compliance important? An ExO Economy Post.

July 10, 2019

The Fluid Chains team with special thanks to @ Nayib Kiuhan for the thoughtful work, has produced a wonderful new document for the ExO Economy and OpenExO Community that I wanted to share here. It was just released today.

This document will also become a part of the Intercom help system on this platform soon if not already.

As many of you know, sometimes gifts of EXOS are given out. When that happened, we use an application created by Fluid Chains that we call the gift app for the management and distribution of the tokens. We originally this this manually. It was painful for everyone involved. We don't do that anymore. :)

Here is the source Post on Yoti, KYC/AML, and why we do what we do in this area. This was produced because this was BY FAR the most frequently asked topic for help/questions in the last several weeks.

OpenExO is using Yoti as its KYC/AML (Know Your Customer / Anti Money Laundry) provider, where the users can create their own Digital Identity. YOTI, a UK based company, is in compliance with GDPR regulation, and the three main compliance accreditations they hold are:

ISO 27001: the international standard for information security management, and is now the best practice for security around the world. ISO 27001 is about protecting all kinds of data, not just personal data. So that’s everything from how the monitor data, who enters Yoti’s offices to how they pick any suppliers or partners to work with.

SOC 2 Type 1: SOC2 (Service Organisation Controls) is all about companies being able to trust each other when providing and outsourcing services. SOC 2 is one of the most respected and rigorous auditing standards for security in the business world. It’s considered rigorous enough for governments, major banks, and the biggest tech companies to use it.

PAS 1296: It’s a Publicly Available Specification (PAS) for Online Age Checking. It sets out regulatory best practices for the sale of age-restricted goods or access to age-restricted services.

YOTI’s global reach permits users to validate their government-issued IDs from more than 160 countries, letting users create their own Digital Identity, through a process that uses Bank-level encryption. After you have downloaded and installed your Yoti App on your iPhone or Android phone/tablet, the steps to create your Yoti Digital ID are:

Yoti is being used by Exchanges and Digital Assets Trading Platforms ( Block Ex, MetaliCoin, Nova, CRIX), Industry companies ( nCloud, Electroneum, Trilliant, TautaChrome, Fun Fair Technologies), and works closely with governments and regulators ( FCA, CTSI, NPCC, OIX, PASS, OFCOM, BRC).

Know your customer (KYC) refers to due diligence activities that financial institutions and other regulated companies must perform to ascertain relevant personal information from their clients for the purpose of doing business with them.

Anti-money Laundering (AML) refers to a set of procedures, laws, and regulations designed to stop the practice of generating income through illegal actions.

As the world begins to adopt cryptocurrency, it’s clear that mass adoption is only possible if governments and corporations embrace the use of cryptocurrency. However, in order for this to occur, cryptocurrencies must ensure regulation is adhered to.

The ExO Economy embraces KYC and AML compliance in compliance with the 5th EU Anti-Money Laundering Directive (AMLD 5). This enables us to work with governments and corporations, who are helping us to introduce EXOS to a worldwide community.

We have become KYC and AML compliant by introducing a verification process that all our users must adhere to, giving the governments and corporations of the world a cryptocurrency they can trust.

SOURCE: ExO Economy Github

In summary, since the earliest days when the ExO Economy was an idea called the OpenExO Protocol back in 2016 we have strived to achieve super-credibility (P. Diamandis) and Transparency within the bounds of governing laws that sometimes impact what we can and cannot do or say.

Please let us know if there is something about the ExO Economy you want to know more about and we'll use those requests as a guideline to continued content generation.

Best,

Kent Langley and the ExO Economy Team

---

This Post is Part of a Multi-Part Series.

The ExO Economy Primer

· Part 1: Yoti and KYC / AML: Or, Why is compliance important? An ExO Economy Post

· Part 2: Staking EXOS in the ExO Economy, Your Economy

· Part 3: The Cities of the ExO Economy Blockchain

· Part 5: The ExO Economy Tipbot

Original content was published by ExOEconomy - Part 1: Yoti and KYC / AML: Or, Why is compliance important? An ExO Economy Post.

July 10, 2019

The Fluid Chains team with special thanks to @ Nayib Kiuhan for the thoughtful work, has produced a wonderful new document for the ExO Economy and OpenExO Community that I wanted to share here. It was just released today.

This document will also become a part of the Intercom help system on this platform soon if not already.

As many of you know, sometimes gifts of EXOS are given out. When that happened, we use an application created by Fluid Chains that we call the gift app for the management and distribution of the tokens. We originally this this manually. It was painful for everyone involved. We don't do that anymore. :)

Here is the source Post on Yoti, KYC/AML, and why we do what we do in this area. This was produced because this was BY FAR the most frequently asked topic for help/questions in the last several weeks.

OpenExO is using Yoti as its KYC/AML (Know Your Customer / Anti Money Laundry) provider, where the users can create their own Digital Identity. YOTI, a UK based company, is in compliance with GDPR regulation, and the three main compliance accreditations they hold are:

ISO 27001: the international standard for information security management, and is now the best practice for security around the world. ISO 27001 is about protecting all kinds of data, not just personal data. So that’s everything from how the monitor data, who enters Yoti’s offices to how they pick any suppliers or partners to work with.

SOC 2 Type 1: SOC2 (Service Organisation Controls) is all about companies being able to trust each other when providing and outsourcing services. SOC 2 is one of the most respected and rigorous auditing standards for security in the business world. It’s considered rigorous enough for governments, major banks, and the biggest tech companies to use it.

PAS 1296: It’s a Publicly Available Specification (PAS) for Online Age Checking. It sets out regulatory best practices for the sale of age-restricted goods or access to age-restricted services.

YOTI’s global reach permits users to validate their government-issued IDs from more than 160 countries, letting users create their own Digital Identity, through a process that uses Bank-level encryption. After you have downloaded and installed your Yoti App on your iPhone or Android phone/tablet, the steps to create your Yoti Digital ID are:

Yoti is being used by Exchanges and Digital Assets Trading Platforms ( Block Ex, MetaliCoin, Nova, CRIX), Industry companies ( nCloud, Electroneum, Trilliant, TautaChrome, Fun Fair Technologies), and works closely with governments and regulators ( FCA, CTSI, NPCC, OIX, PASS, OFCOM, BRC).

Know your customer (KYC) refers to due diligence activities that financial institutions and other regulated companies must perform to ascertain relevant personal information from their clients for the purpose of doing business with them.

Anti-money Laundering (AML) refers to a set of procedures, laws, and regulations designed to stop the practice of generating income through illegal actions.

As the world begins to adopt cryptocurrency, it’s clear that mass adoption is only possible if governments and corporations embrace the use of cryptocurrency. However, in order for this to occur, cryptocurrencies must ensure regulation is adhered to.

The ExO Economy embraces KYC and AML compliance in compliance with the 5th EU Anti-Money Laundering Directive (AMLD 5). This enables us to work with governments and corporations, who are helping us to introduce EXOS to a worldwide community.

We have become KYC and AML compliant by introducing a verification process that all our users must adhere to, giving the governments and corporations of the world a cryptocurrency they can trust.

SOURCE: ExO Economy Github

In summary, since the earliest days when the ExO Economy was an idea called the OpenExO Protocol back in 2016 we have strived to achieve super-credibility (P. Diamandis) and Transparency within the bounds of governing laws that sometimes impact what we can and cannot do or say.

Please let us know if there is something about the ExO Economy you want to know more about and we'll use those requests as a guideline to continued content generation.

Best,

Kent Langley and the ExO Economy Team

---

This Post is Part of a Multi-Part Series.

The ExO Economy Primer

· Part 1: Yoti and KYC / AML: Or, Why is compliance important? An ExO Economy Post

· Part 2: Staking EXOS in the ExO Economy, Your Economy

· Part 3: The Cities of the ExO Economy Blockchain

· Part 5: The ExO Economy Tipbot

Original content was published by ExOEconomy - Part 1: Yoti and KYC / AML: Or, Why is compliance important? An ExO Economy Post.